The low tax, along with other benefits, has encouraged hundreds of gaming companies to retain their offices in Malta and Gibraltar, regardless of the Point of Consumption Tax. Still, just like any other industry, the gambling sector is always looking for new ways to make a profit and pay less tax. Gambling Tax Around The World withdrawn at any time. Real money funds used first. Free Spins: Available after deposit bonus is redeemed/lost, credited as £2 bonus. MONOPOLY Live only. 1x wagering and Max bonus bet of £5 applies to winnings, 7 days to accept & 7 days to complete wagering, maximum withdrawal from winnings is £200.

- Gambling Tax Around The World Per

- Gambling Tax Around The World Chart

- Gambling Tax Around The World 2019

- Gambling Tax Around The World 2020

In the United Kingdom, it was basically illegal to place a bet of any kind for the best part of five-hundred years. The exception to this was on horse racecourses, which were the only places where you could place a bet legally before 1961. That’s when betting shops opened and you could pop into one of them to have a flutter on any of the sports that they covered, though it was mostly still horse racing. Ever since then the laws have changed and developed but mostly remained the same, which is to say that they no longer ban you from betting as long as you’re over the age of eighteen. How you can bet and what you can bet on might be restricted, but only slightly. Even the age restriction, for example, depends on what the ‘gambling’ is that you’re looking to do. The Gambling Act of 2005 says that those over sixteen can play the National Lottery, buy scratchcards or do the Football Pools. Kids of any age can do a raffle or something where the house has no edge.

In short, the gambling laws in the UK are there to protect the citizens of the country rather than restrict what they are and aren’t allowed to bet on. That is grossly different to some other major countries around the world, with the United States of America being one of the most obvious examples. Why is it that betting is so much harder in other countries? What are the rules on using an online betting account when you’re outside of the United Kingdom? What are the tax implications surrounding winning money in another country? If you head to Las Vegas, for example, where gambling is legal, do you have to pay tax on your winnings? These are all the sorts of questions that punters might understandably ask before heading abroad, especially if they enjoy having a flutter as a past-time. We’ve taken a look at the answers and will do our best to explain how gambling restrictions kick-in when you leave these shores for foreign ones. It’s important to note that this will by no means be an exhaustive look at the topic.

- The ICSS, in partnership with Sarbonne University, looked at data on tax havens, legal and illegal gambling, online betting and match fixing. The international sports-betting market is worth an.

- Around this time, online gambling was on the rise, and the UK government feared the UK gambling industry would suffer thanks to outside competition. Nowadays, the UK gambling industry it as strong as ever, so it seems like the changes in the tax system were a good move.

What Are Gambling Rules In Other Major Countries?

Gambling Tax Around The World Per

There’s no point in looking at the gambling laws of every other major country in the world, if for no other reason than there are as many rules as there are countries instigating them. It also gets further complicated when you look at large countries like the US, given that there are different rules in place from one part of the country to another. Yet it’s important to at least mention some of the various rules in order to help understand the freedom that we have in the UK when it comes to betting and gambling. You’ll find that similar rules apply to both online and on-land gambling in Germany and Spain, for example, whilst Middle Eastern nations such as the United Arab Emirates, Brunei and Qatar have long outlawed any kind of betting. Things get interesting when you look at the likes of Vietnam, where gambling is legal for tourists but illegal for those that are from the country.

There are a number of similarly interesting cases where it feels as though the ruling government can’t make up its mind on whether something should be illegal or not. As an example, you cannot legally go to a casino in Japan, but you will be able to bet on motorcycle racing, powerboat racing, horse racing and bicycle racing without falling foul of the laws of the country. You’ll also likely be able to find some casinos if you try hard enough, but the likelihood is that these will be run by crime syndicates like the Yakuza. There are also loopholes in Japan for games such as Pachinko. It is illegal to win money playing Pachinko, you see, but you can win tokens that can be swapped for prizes. You’re also allowed to sell those tokens elsewhere, meaning that you can indirectly earn money playing the game.

There are countless countries around the world that apply no restrictions whatsoever on gambling, whether that be online or on-land. The likes of Angola, Jamaica, Liechtenstein, the Federated States of Micronesia and the Swaziland all fit into this category. It’s worth bearing in mind, though, that that’s not necessarily a good thing. After all, a lack of restrictions on gambling means that there’s also unlikely to be a huge heap of legislation on the matter, so your funds won’t always be protected. It’s why looking towards countries that have licensing authorities will always serve you better than placing your bets anywhere you happen to be that you can find a casino.

Gambling In The United States of America

As one of the largest developed countries in the world, it’s only right to take a quick moment to discuss the gambling laws in the United States of America. The issue here is complicated by the fact that each individual state can instigate its own rules and laws. There are two States, Hawaii and Utah, that have made any type of gambling illegal, whilst there are three that allow every sort of gambling possible in the State. These are Pennsylvania, New Jersey and Delaware. The only gambling that you can’t do in those States is tribal, but that’s only because it doesn’t apply as a possibility rather than it being banned there. You’ll notice that none of those States are Nevada, the home of the biggest gambling Mecca in the US, Las Vegas. That’s because Nevada has banned lotteries and racetrack betting.

You are allowed to bet online in just four of the States in the US, which are the four we’ve just mentioned. The rest have prohibited online gambling, which means that there is a huge market that cannot legally place a bet when on the internet. This is determined by the Unlawful Internet Gambling Enforcement Act of 2006, which doesn’t mention state lotteries or horse racing events. As we’ve mentioned, it’s a complicated topic in the United States. For example, in 2011 three of the biggest poker companies in the world, PokerStars, Full Tilt Poker, and Absolute Poker, were found to be violation of the UIGEA by ‘lying to banks about the true nature of their businesses’ and arranging for 'the money received from U.S. gamblers to be disguised as payments

to hundreds of non-existent online merchants’.

The interesting thing about the States is the likelihood that betting laws might be relaxed in the future. There are Indian reservations around the country that do have casinos that you can head to to place a bet, so it’s not as though there isn’t an appetite for it. It’s also been estimated that the turnover of all illegal bookmakers that have operations in America amounts to around $400 billion. It will take a reasonably large shift in the American psyche to get to the point that betting is accepted around the country, though. In the 1980s, for example, two of Major League Baseball’s greatest players, Mickey Mantle and Willie Mays, were given bans for working as greeters at Atlantic City casinos. America’s relationship with gambling is a strange one, with citizens of the country allowed to bet on fantasy sports anywhere but not on real ones. That will likely change if the Treasury believes it can start to gain some tax money from the industry, however.

Tax Implications On Gambling Winnings From Abroad

If you’ve read the rest of this article, you probably won’t be surprised to discover that even the tax implications of a win are a complicated matter. Obviously the country that you win in will dictate the outcome of any tax you’ll have to pay, but even within countries there are different rules and laws. As an example, let’s stick with the United States and Las Vegas casinos. In the US there’s a difference between having to pay tax and having some of your winnings ‘withheld’. Whether that happens will also depend on where you’re from. The Internal Revenue Service asks casinos to withhold between 25 and 30% of winnings as income tax, though this doesn’t apply to table games like blackjack or three-card poker. This is because you’re required to pay income tax on your winnings if you’ve won over six-hundred dollars or three-hundred times the amount of your original wager, but it’s impossible to keep track of your original wager during table games.

The good news is that the above doesn’t really apply to British citizens that pay tax in the UK. You can check the exact details out with the IRS directly, but in short none of your winnings will be withheld if you’re able to prove that you’re from the UK. Even if some of the money you’ve won is withheld, you’re normally able to claim it back once you’ve returned home. There are numerous other countries that the residents will find themselves the beneficiaries of the same rule, such as people from France, Italy, Russia, Spain, Turkey and the Ukraine. The US is the best example to talk of when it comes to taxation, simply because it’s probably the most complicated. Other countries have their own rules, such as Greece’s 10% tax on lotteries or South Africa’s 6% on horse racing. It’s worth checking the law on each individual country if you’re planning on heading abroad and having a flutter to ensure that you don’t fall foul of their taxation laws. Generally speaking, though, the likelihood is that there’ll be a treaty with the UK to mean you don’t need to worry about tax when abroad.

In the United Kingdom, the Betting Duty used to be 6.75%. However, the then Chancellor of the Exchequer, Gordon Brown, abolished that in 2001. Yet that doesn’t mean that there’s no tax to pay when it comes to gambling in the UK. It’s just that the tax is paid at what is referred to as the ‘Point of Consumption’. That means that bookies and gambling providers have to pay a 15% duty on bets placed by punters in the UK, regardless where the companies are based. That is due to the Gambling (Licensing and Advertising) Act of 2014, which introduced a Remote Gaming Duty. The short answer is that you don’t need to worry about, though the longer answer might point out that bookmakers may well alter their edge in order to cover the tax that they have to pay on their takings.

Betting Online When Abroad

We know, then, that different countries have different rules regarding gambling in general, but what about betting online if you’re a UK resident on holiday in another country? It’s legal to gamble on virtually everything in the United Kingdom if you’re over eighteen years of age and online gambling is legal here too, so there surely can’t be any restrictions, can there? If only life was that simple. The simple truth is that you’re beholden to the laws of the land that you find yourself in. That’s why American students under the age of twenty-one are allowed to drink alcohol when they’re in the UK as long as they’re over eighteen, even though they wouldn’t be in their home country. As we’ve already mentioned several times, different countries have different laws when it comes to betting online, so you’ll need to check them out before you try to access your account from abroad.

One thing that you can do is have a look at which bookmakers operate in the most countries. If you use a company such as Coral, for example, then you’ll be able to place bets from the likes of Argentina, Macedonia, New Zealand, Albania, the Czech Republic and Sweden. If you’re not entirely sure whether you’ll be able to bet from the destination country you’re heading to then get on to the support team of the bookie you use most often to place your bets and ask them. The reason it’s important to check this sort of thing out is that bookmakers have to get licenses to operate in each and every country, so if they don’t have a license for the country that you’re holidaying in then you’ll likely be breaking your terms and conditions of service by trying to bet whist you’re there - even if you use a VPN or similar. After all, if you break their Ts & Cs then it’s possible they won’t honour your bet.

It is no brainer that gambling is a form of recreation in most countries around the world, which is also a constant source of revenue that builds up the counties economy. How does it do this? Of course, by waging taxes on the casino establishments or on winning individuals. What was once a recreational activity for many years has diverted its path in becoming a billion-dollar industry now!

Hundreds of countries around the world have legalized gambling(Must Watch), and some are on the verge of doing so. There is no standard law which governs the taxes waged on the casinos, common for all. They are handled differently not only in different countries but also differ among sates of the same country. This could be quite intimidating, especially if you’re a traveller or a professional gambler. Sometimes casino owners pay directly to the taxman or the government, and on the flip side, some countries demand a percentage of an individual’s winning in the form of tax. Other countries demand a cut only if you’re a professional or if it’s your primary source of income. Let us discuss some of the countries that impose highest to the lowest taxes in the world:

Counties with the highest tax on gambling

- Germany: The county contributes to about 20-80% of the gross gaming revenue from land-based casinos and 18% VAT from its online counterparts. Sports betting like horse racing contribute to about 5%of the states and lotteries contribute a whopping 16%.

- UK: Because the UK falls under the umbrella of one of the most top gaming countries, it is comparatively liberal in terms of their taxes. Depending upon the GGY of the land-based casinos, it can vary anywhere from 15% to 50% and 21% from its online counterparts.

- Macau: This city is the only hope for gambling lovers in China and around; hence they impose lumpsum taxes on gambling with 40% from land-based casinos, of which 1.6% is contributed to the Macau Foundation and 2.5% for socio-economic causes.

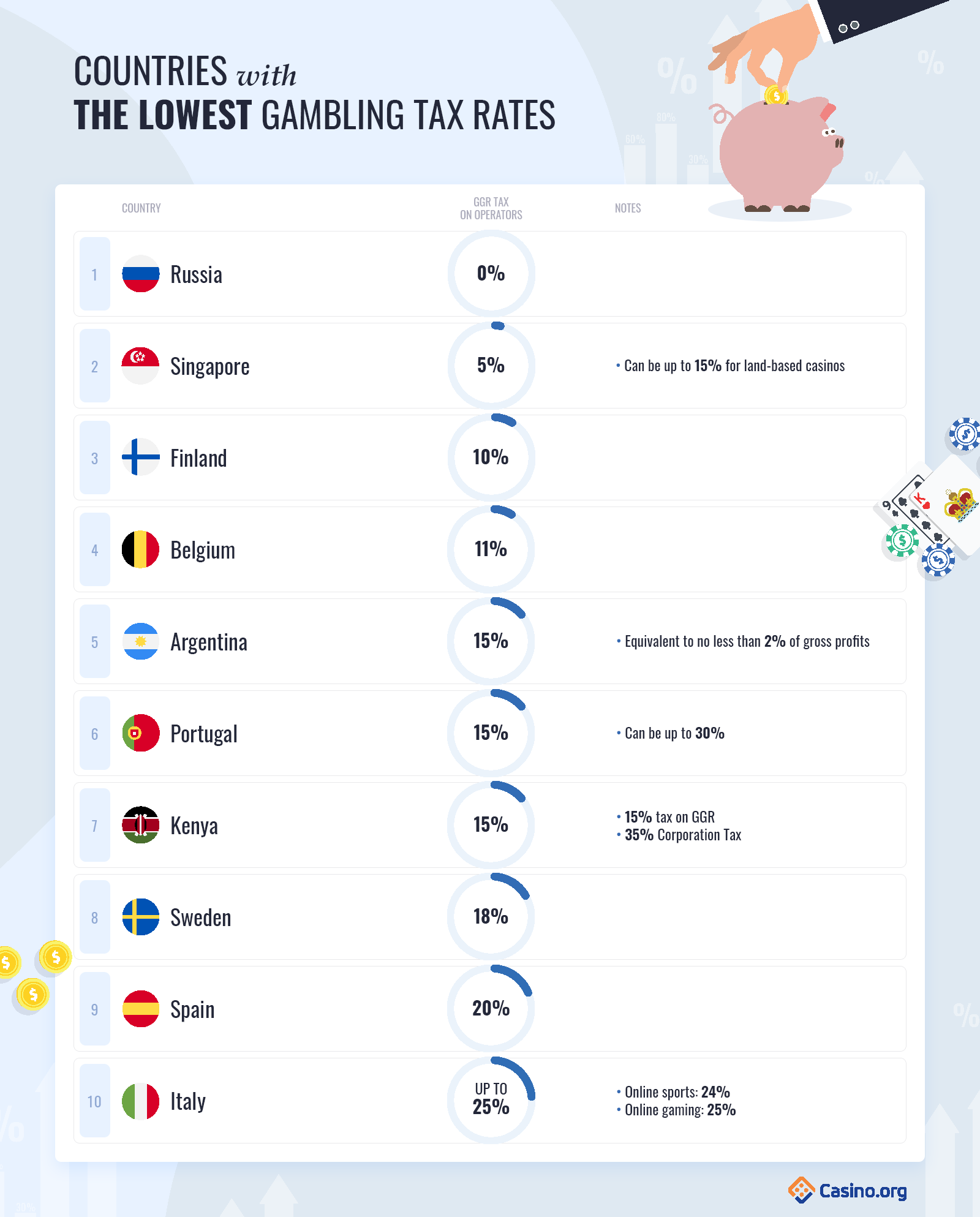

Countries with the lowest tax on gambling

Gambling Tax Around The World Chart

- Italy: The country has made some modifications to their tax percentages from 2018 by increasing it on the land-based venues. It has been elevated from 20 to 24% and its online counterparts from 18 to 20%. This growth is still reasonable, considering the industries popularity in the country.

- Singapore: The country is still a newbie in the game of casinos, and hence most of their gambling revenue stems from the Marina Bay Sands and the Resorts World Sentosa. The owners either have to deposit $100,000 with five %GGR or 15% of the GGR for all other players.

- Portugal: Recent upgrade in the tax system from 18% to 25% has become an intimidating topic in the country. With lottery winners owing to 20% of their winnings.

Gambling Tax Around The World 2019

Countries with no tax on gambling winnings

Gambling Tax Around The World 2020

- Finland: Gambling operators are demanded to pay 10% of the lottery winnings and 30% of their gross gaming revenue to the government.

- CzechRepublic: As of 2016, operators were compelled to pay 20% of their gambling revenue, but increased it to a good 35% in 2017, of which casinos pay 19% of corporate tax as well.